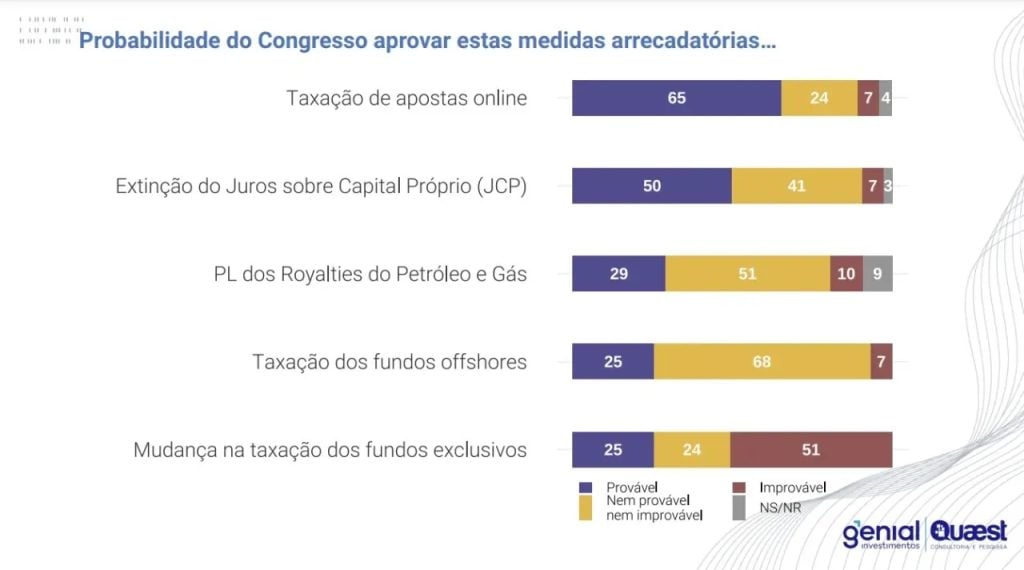

A Genial/Quaest survey carried out with federal deputies in office, announced last Thursday, the 10th, indicates a good probability of approval of the taxation of sports betting in the National Congress.

The parliamentarians consulted see a high probability of the Chamber of Deputies and the National Senate approving this agenda forwarded via provisional measure by the Federal Government.

According to the survey, carried out between June 13 and August 6, 65% of respondents consider it likely that parliament will approve the taxation of sports betting.

Only 7% indicate low chances of advancing the measure. While 24% of respondents consider neither likely nor unlikely.

In all, 185 face-to-face and online interviews were held with federal deputies in the exercise of their mandates.

The sample was defined according to strata of region and ideological positioning of the parties (left, center and right).

The estimated maximum margin of error is 4.8% up or down.

The collection period took place between June 13 and August 6, capturing the extremes of Lula’s relationship with the National Congress in his third term.

Sports betting tax

According to the sports betting PM, bookmakers will be taxed at 18% on the so-called “Gross Gaming Revenue” (GGR). That is, the income earned from all games after winning prizes have been paid out to players.

Taxes collected from sports betting sites will be divided as follows:

- 10% for social security,

- 0.82% for basic education,

- 2.55% for the National Public Security Fund,

- 1.63% for clubs and athletes,

- 3% for the Ministry of Sport.

While the prize is awarded, the bettor will be taxed at 30% of the Income Tax. However, all prizes up to R$ 2,112.00 will be exempt.

With the betting regulation, the Federal Government projects to collect about R$ 3 billion per year. In the coming years, the estimate is higher and varies between R$ 6 billion and R$ 12 billion.

However, the norms need to be appreciated by the National Congress within four months in order not to lose their value.