Roberto Carvalho Brasil Fernandes is a Lawyer, Jurist – author of the book “Law of Lotteries in Brazil”. Forum. 2020” and several legal articles on the research topic. Member of the Gaming and Lottery Law Commission of the OAB Nacional and IAB Nacional. He was a lawyer for ABLE – Associação Brasileira das Loterias Estaduais (2006 to 2017), in actions before the STF and STJ, with representation of the entity in the Chamber of Deputies ((RICD/3.008.963).

Check below the lawyer’s contributions to the Parliamentary Commission of Inquiry – CPI on manipulation of results in football matches in the Chamber of Deputies.

“I make my contributions to this CPI with the premise adopted in the defense in the Federal Supreme Court, which ensured respect for the Federal Constitution regarding the competence of federated entities in this matter.

1.2 The main theme of this exhibition is about the lottery modality called “Fixed Quota Bets” (AQF), legalized in the country in the text of Law 13,756/2018 and its respective implications for football in Brazil.

1.3 Initially, I note that in Brazil, Variable Quota Sports Betting has been taking place for many years, the so-called LOTECA, whose betting has already taken place on the results of football matches. This modality is explored by the Caixa Lottery, but it should not be confused with the AQF modality, whose most significant difference is the prize calculation: bet value multiplied by a “fixed quota”. I also note that football games that officially take place in Brazil are already the subject of betting in several other countries around the world, and, strictly speaking, do not depend on Brazilian law for their achievement.

I also highlight the conceptual confusion of the terms adopted in presentations to this Commission, which often compromise the understanding of the matter.

1.5 And, as a consequence of the nature of the lottery activity of sports betting in the country, it is necessary to provide definitions of the nomenclatures to assist in reading the phenomenon: Lottery, Lottery Modality and Lottery Product, terms that integrate what I call Lottery Law in Brazil.

1.6 Therefore, I propose a semantic agreement, so that concepts are not confused and contaminate positions, even if divergent, expanding the legal certainty of the norms created in this Legislative House, having as a theoretical basis the most current literature and the position of the STF, espoused in the debates of ADPFs 492/RJ and 493/ABLE, in the following terms:

Lottery: in a broad sense, it is a public service whose main purpose is to obtain, voluntarily, original public revenue, intended to finance social demands defined by the federated entity that institutes it; In a strict sense, the Lottery is a public body or entity responsible for regulating, supervising and operating, directly or indirectly, the aforementioned public service, in accordance with regional peculiarities, and directing resources to social demands of public interest.

Lottery Modality: normative type, provided for in stricto sensu federal law, which defines the form and possibility of operating lottery services and provides a basis for the creation of lottery products.

Lottery Product: is the expression, through regulatory acts, of the use of the opportunity and convenience of the public administrator when allowing the operator to exploit a product belonging to a certain Lottery Modality typified in stricto sensu law. In this sense, Lottery Product is the operationalization of the lottery activity, through which the ultimate consumer good of this activity finally reaches the consumer/user, in a regulated market environment, namely, the instrument that gives them the chance to obtain a award and, at the same time, voluntarily contribute to a purpose of public and social interest.

1.7 Expressions such as “lottery service”, “public lottery service” or “lottery service” refer to what I call the Lottery in a broad sense. While Lottery in the strictest sense refers to the place and space2 where the consumer goes to buy a lottery product. More than an etymological question, I argue that this idea is already shared in current language, as it is common to call “Loteria” traditional institutions for operating lottery bets, such as LOTERJ, in Rio de Janeiro, Loteria Mineira, in Minas Gerais , or even LOTEP, in Paraíba.

They are, therefore, meanings that can serve as a tool for this Commission to describe and develop the object of the CPI, without making the mistakes of some previous legislation. This proposal arises mainly after the joint judgment of the aforementioned ADPFs 492 and 493 by the Federal Supreme Court, where the Court’s decision, in saying that the Union’s competence (art. 22, XX of CRFB/88) does not exclude the possibility of exploitation of the public service by states and DF (art. 25, §1º), means that it is up to the Union to create lottery modalities, without excluding the right of other state entities and the DF to manage the lottery betting market in their territories through of their own Lotteries (in the strictest sense), authorizing the respective exploitation of lottery products, in the interest of the local public interest. The Court’s decision corroborates to demonstrate the correctness of this classification, whose ideas were already present in the initial ADPF 493, filed in 2017 by the Brazilian Association of State Lotteries, which was accompanied by the state of Rio de Janeiro and another 17 states of the Federation and , in the specialized Doctrine, notably in the work: Lottery Law in Brazil, published months before the ADPFs trial, in 2020.

Having made these introductory notes, I return to the central theme for defining the fixed-odd sports betting institute – AQF in Brazil.

1.10 As already mentioned, AQF were legalized in Brazil as a lottery modality, provided for in art. 29 of Law 13,756/2018. Therefore, from the outset, it can be said that it is not correct to say that they are “Lotteries” in the strictest sense; They are, properly speaking, a lottery modality. As a result, they began to have, in the country, the same legal nature as numerical prediction contests (the Union has as examples of lottery products Mega-Sena, Loto Fácil, etc.), the instant lottery modality (LOTEX), the passive lottery modality (called “Federal Lottery”), among other modalities provided for in the list of art. 14 of the same Federal Law.

1.11 The logic is as follows: in the same way that the lottery modality of numerical prediction contest has Mega-Sena and Loto Fácil as examples of products within the scope of the Union, the AQF modality will have lottery systems platforms as its lottery products. bets – internet sites and their names, popularly known with a fancy name and the inclusion of the term “bet”.

1.12 Thus, while for the Public Authorities the AQF modality is another of the options present in the portfolio of activities that it can develop as a lottery service and, therefore, collect and control the market, from the perspective of the private sector, it is a product (lottery) that can be exploited commercially depending on the entrepreneur’s conditions, investment and risk.

LEGAL NATURE OF THE LOTTERY MODALITY AND DISTINCTION FROM “GAMBLING”.

2.1 The legalization of AQF as a lottery modality, removed them from the field of economic activities stricto sensu, since, in the tradition of Brazilian law, lottery activity is conceptualized as a public service – an “atypical” public service, as the doctrine reservation, but which fulfills its function by promoting revenue for investment in relevant social demands, such as that provided for in article 195, section III of the Federal Constitution. This is, therefore, its legal nature.

The art. 29 of Law 13,756/2018 established the possibility of exploiting the lottery product in the form of AQF, by concession or authorization to the private sector, with monopoly being prohibited.

2.3 Therefore, in order to begin the activity with legal certainty, it will be necessary for the Public Authorities to regulate Law 13,756/2018 and carry out administrative procedures to delegate the execution of the service.

2.4 Therefore, only after being duly authorized by a competent authority, the exploitation of this lottery modality will not be confused with that typified in criminal law as “Gambling”.

2.5 In this case, and to differentiate between lottery services and gambling, I take into account at least three criteria:

The first is teleological, about the Lottery’s reason for being. What differentiates Gambling from Lottery Modalities are the public interest, the indispensable federal law that covers this modality and the normative regulation of the competent bodies of the Union and States.

After all, the main function of lottery activity is to serve as an instrument to finance social security and other public interest. Still on the reason for the lottery, it is worth highlighting that art. 26 of Law 8,212/91, when dealing with sources of social security financing, refers to “prediction contests”, that is, one of the lottery modalities. Games of chance, like those typical of casinos, are marked by private interest and considered an economic activity in the strict sense, distinct from the public service characteristic attributed to the lottery modality of fixed-odd betting.

The second criterion, conceptual, refers to the requirements that make up the Game of Chance. There is actually no GAME in the dynamics of the lottery modality. There is a bet on a sporting competition, the result of which is obtained by competing the skill of the competitors. In this case, theoretically, there are the following moments: (i) bet, (ii) result of a competition and (iii) prize. In the criminal practice of “Gaming of Chance”, lato sensu, there is a (i) bet, (ii) a draw with a random result and (iii) the prize.

Take, as an example, Mega-Sena, a lottery product in the numerical prognosis modality in which there is a bet, a random draw and a prize, identical to the conduct of the so-called “Game of Chance”, provided for in Brazilian Penal Law for many years. , with Decree-Law No. 3,688/41 persisting in our legal system, which defines criminal offenses.

But, Mega-Sena is not a Game of Chance. It is an activity based on a lottery modality provided for in Federal Law, which is operated by those authorized (in this case, the Caixa Econômica Federal Lottery) and there is direct public interest.

Thirdly and finally, there is the legalistic criterion. According to art. 40 of Decree-Law No. 6,259/1944, Gambling is the “unauthorized lottery of any kind”. It is necessary to bear in mind that, when the criminal legislator refers to “a type of lottery”, he is referring to what here I call it Lottery Modality. That said, it is clear that, once the sports betting activity is authorized by the public authorities of the Union or the States and the DF, it cannot be considered gambling or illicit conduct. Necessary highlight the limitations of this criterion, since the legislator, at the time, adopted the broad concept of gambling with the aim of applying the same criminal reprimands to conduct that he intended to prohibit, without adopting great care in conceptual matters.

However, it cannot be ignored that paying a foreign lottery prize in Brazilian territory is a criminal offense provided for in Decree-Law No. 6,259/44 (Note: AQF, in Brazil, is a lottery modality); as well as receiving sponsorship from a sports betting website that captures bets in Brazilian territory, over the internet, on sites like “.com.br”, whose sponsorship value is linked to the amount of bets captured in Brazil, characterizes participation in a “game of chance” – here conceptualized as “unauthorized lottery”.

2.7 It is concluded, therefore, that the Lottery is not a game of chance, but the exploitation of lottery products by the private sector – which, if in disagreement with the legislation and limits of the respective state authorization, can attract criminal offenses.

2.8 I reiterate this position, due to the ostensible practice of betting capture activities in Brazil. Because, strictly speaking, there is no “gray market” in our country, in such a way that: either it is a legalized activity and its exploitation authorized by the competent public authorities, or an unauthorized legalized activity, which attracts the criminal type and continues to happen due to tolerance or conceptual confusion. And, in the case of sports betting that operates in Brazilian territory (I am referring here to the jurisdiction), and consequently sponsorships that are calculated based on a percentage of the amount bet, are clearly illegal. Obviously, the law is not enough to provide legal security to companies to carry out this activity, but only through it must the act of authorization or concession take place, under penalty of having a market operating within legality and another competing market, tolerated and compromising all benefits of the new lottery: integrity, protection and collection.

2.9 Still, by way of reinforcement of the argument regarding the legal nature of the Lottery, some treat the commercial exploitation of lottery modalities as being a way of obtaining “voluntary tax”, but I prefer to understand it as a “state development activity, to finance social security” and other areas of public interest, including public security, sport, culture and others.

2.10 It is necessary to adopt the concept of public service for lotteries, as per the majority doctrine, exemplified in the words of Caio Tácito and Gustavo Henrique Justino de Oliveira:

It is true that the lottery established by the Union, or by the Member State, does not have the essential nature of a public service of its own, as a prerogative inherent to state activity. This is what the traditional doctrine calls improper public service, the result of the law that qualifies it as such. (Gaius Tacitus).

Strictly speaking, lottery activity does not constitute an ‘administrative provision activity’. And if it is not a question of provision, the lottery game operated by the State does not directly generate the satisfaction of the needs of the community, in other words, there is no ‘service to the public’. What happens, in truth, is the obtaining of revenues, resources for the Treasury and which are destined for some areas or sectors in which the State operates, such as social assistance or even the encouragement of activities sports. The legal nature of the lottery activity would be, if previously considered a state activity, that of promotion, and not that of public service, as the characteristic and defining notes of public service are not present in it.”4 (Gustavo Henrique Justino de Oliveira).

Therefore, the state’s activity is not to sell lottery tickets on street corners or to develop and sell products on websites, but it is up to the Lottery’s public officials to standardize, monitor and manage this market, to control the offers of products and consequently obtain revenue to make the social investments provided for in the Law. Hence the decision to consider the Lottery, a public service defined by law, as a state activity to promote the financing of social demands.

TAXATION AND ORIGINAL REVENUE

3.1 Law 13,756/2018, it seems, is aligned with some of the best international regulatory practices, but needs to be regulated as soon as possible, due to legal imposition and due to the social importance and safety of sport and society.

3.2 It is not unknown, however, that the form of taxation (and original revenues) deserves future improvements. Currently, in all lottery modalities, income tax is levied on the prize, without taking into account an important difference between AQF and other modalities: in AQF, the prize is bankrolled (hence the expression “fixed quota”); In other modalities, the value of the prize is prorated (which can also be called “variable quota”, examples of which are Mega-Sena, Loto Fácil, etc.). This treatment, as it does not recognize technical peculiarities, may prove to be an inadequate and disastrous strategy for what is intended with legalization.

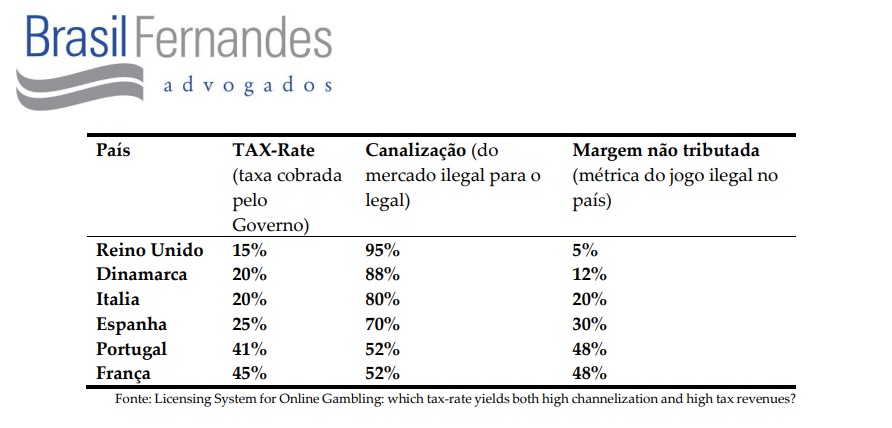

3.3 The most successful experiences in regulating sports betting are those in which the tax burden is very adequate/moderate on the activity and the main objective is control of the market by the Public Authorities. The article “Licensing System for Gambling, by Copenhagen Economics5”, with data collected from 2013 to 2016, describes the conflict between taxation, collection and channeling fees – from the informal to the regulated market.

It is necessary to clarify some technical terms of the study for analysis and conclusions:

Tax-rate, in practical translation into our language, would be the total taxes charged by the government on the company’s revenue or volume. Channelization is the metric that represents how much money circulated in betting in a given country and circulated in licensed operators subject to taxation. In this way, the channel also represents the amount of money that circulated in the illegal market. Channeling is the most important metric for understanding the effectiveness of regulation in the sports betting market.

Finally, untaxed margin refers to betting money circulated outside the legal and government-taxed margin. It would be the margin corresponding to illegal bets.

3.5 These issues influence the tax calculation basis. The experience of Portugal, where taxation is based on the volume of bets (turnover), made that country one of the worst models in terms of channeling the illegal into the legal, having attracted only 25% of the market between 2018 and 2023, according to data from the UK Gambling Commission – UKGC and the Portuguese responsible body. (Source ABAESP6).

It can soon be seen that the level of taxation is inversely proportional to the channeling rate of activity regulation.

3.7 In Brazil, there is another negative ingredient regarding taxation, which can compromise the efficiency of the regulated market. I am referring, in addition to the high rates on business activity, to the tax on prizes in fixed quota modalities. In this case, the global practice is NO TAXATION on the prize. If this dynamic persists in Brazilian legislation, the rate of channeling from the illegal to the legal market could be affected by more than 25% (as it is assumed that 75% of the premiums to be paid will be lower than the first range of the IR table, therefore , exempt), which will reduce the calculation basis for applying other taxes and original revenues, in such a way that there will be losses in all aspects and to all parties in the process (government, operators and bettors), not just in terms of revenue final, but to the objectives of ensuring better levels of sport integrity and consumer protection.

3.8 The difference is easily observed in “variable odds” products, such as the Mega-Sena example: in a certain recent event (draw 2,625), the value of the bet and the expected maximum prize were in the order of R$5.00 bet for a prize of R$37 million – that is, the amount bet multiplied by 8.22 million times –, while in a fixed odds bet, such as sports betting – AQF, the average multiplier factor (the Odds) is 1.5 to 5 times the amount bet. There is no way to tax these two modalities with the same formula.

Therefore, one of the possible improvements to Law 13,756/2018 would be to eliminate taxation on the fixed-odd bettor’s prize in order to increase the channeling rate and, consequently, increase the calculation base for all other taxes applied. and original revenues, which would increase control over the market regarding the integrity of the sport and the treatment of compulsive gamblers.

THE REVENUE EXPECTATION FOR THE GOVERNMENT. BRIEF ANALYSIS OF CONSEQUENCES

4.1 The expected value of tax revenue will depend on the exploration model adopted by governments, which will impact the level of i) interest and investments from the private sector and ii) channeling bets from the informal market (domestic) and offshore market (international) to the controlled, taxed and revenue-generating environment.

4.2 I highlight, in this regard (revenue generation), as a fundamental point for the success of this new lottery modality in Brazil, considering successful international experiences[1], not only the rates, but also the calculation basis and the generating event of the exaction.

4.3 First, remember that the tax only exists to achieve a purpose of public interest, and in the case of AQF we are dealing with a public service defined by law. Therefore, one cannot distance itself from the macro/main objectives of this lottery modality, in which I support, in the following order: the integrity of the sport, the protection of the consumer/player and the revenue for the governments (of the Union and the states and DF).

To achieve the objectives listed in the paragraph above, where it is clear that tax and non-tax collection cannot be the main objective of this lottery modality – but ends up being a consequence of the other successes. The benefits will be proportionally greater the greater the channeling of the betting market into the formal environment, in Brazilian territory, forming the calculation basis.

4.5 The triggering event, it seems to me, cannot be the amount of the prize, but the financial advantage obtained in a given period, under penalty of the deposits becoming taxes due in full from a certain amount of bets. If you do not change the calculation basis, with each new bet, even if it is a winner, the deposit amount will be reduced, until you have neither deposit nor prize to receive.

4.6 The rate, the triggering event and the calculation basis for bets will be perceived by the market and will determine the operators’ investments and the consumer’s choice of bets, impacting the channeling to the formal environment.

Channeling the market is inseparable from the objective of revenue and better levels of integrity in the sport. The universe of application of technological tools on a) the behavior of bettors, b) of actors/players, judges, etc., during the game and c) of the control of betting houses has its efficiency directly proportional to the percentage of market channeled and subjected to these same tools, which will also impact revenue.

4.8 Therefore, if bets placed and Lottery Operators/Bookmakers are not operating within the formal environment, controlled by Governments (channeled), the efficiency of control and collection will be seriously compromised. The greater the environment controlled by Governments, the less possibility of manipulating results and the greater the revenue.

I therefore consider that the government is responsible for identifying rates that do not inhibit the attractiveness of the business sector that will invest and submit to the rules and risks of the business. Therefore, the efficiency of the rate must be measured and defined based on the respective “Spirit of the Law”. The theory of the “Laffer Curve”7 gives objective signs of the error in applying a high tax rate to certain business activities. The economist highlights the obvious: where 0% and 100% tax rates generate revenue equal to zero. Therefore, the rates must be in an acceptable zone to achieve the objectives of the Law, in such a way that, the higher the rate, the lower the channeling of bets and, consequently, the less control for the application of management and integrity tools and, also, lower revenue, tax and non-tax, on the exploration of AQF.

MOTIVATION FOR REGULATING THE ALREADY LEGALIZED SPORTS BETTING MARKET IN BRAZIL

5.1 I list several justifications, legal and ethical, for the Executive Branch to carry out, from now on, the regulation of AQF, namely: (a) because it is legalized; (b) for the integrity of national sport; (c) to prevent foreign exchange evasion; (d) for consumer/bettor protection; (e) to generate legal sponsorship for national sport; (f) to generate tax and non-tax revenue for the Union; (g) to generate revenue for clubs, federations and companies; and (h) to generate employment and income

(a) Because it is legal:

5.2 The Chamber of Deputies and the Federal Senate, after intense debate and public hearings, approved and the head of the Executive sanctioned Federal Law 13,756/2018. Therefore, even if the legal deadline for regulation has expired, the Federal Government has the obligation to regulate the matter.

5.3 I am not unaware of the TCU’s position, given in TCU Ruling 1722.2023: “there is no omission on the part of the Ministry of Finance in relation to the lack of regulation of Law 13.756/2018. What can be observed is that the matter, in fact, is complex and involves economic and political sensitivity, but that, given the measures in progress, it does not yet require action from this Court in order to issue determinations and/or recommendations.”

5.4 However, I adopt, as clarification of this point, the article by Professor Regis de Oliveira, published on 03/09/2023. The author argues that “if the State cannot, for the purpose of legislating, commit unconstitutionalities, equally, it cannot, under the pretext of not issuing regulatory decrees, fail to meet the interests contained in the norm, which is unconstitutional.”

5.5 Along these lines, I argue that, even after the deadline, the Executive can (and should) regulate, without this representing illegality. This is because, since art. 84, IV of the CRFB gives the Executive the prerogative to faithfully execute the law through decree or regulation; an infra-constitutional norm could not “prune” this Executive prerogative. The prerogative derives directly from the Constitution and interpreting it in accordance with the law would be subverting the interpretative process compatible with the Constitutional Rule of Law. The law must always be read in light of the Constitution and not the other way around.

(b) For the integrity of national sport:

5.6 In an environment where there is an intense offer of bets on sporting events, such as in Brazil, only with the adoption of specific technology to manage events and control who bets and who wins the prize resulting from a sporting competition will it be possible to identify possible deviations by actors (players, event judges, bettors, etc.) and prevent them by monitoring data and combating manipulation of results. One of the parties most interested in the integrity of sport and the results of games are the formal operators, authorized to explore the market, as financial loss, in the event of fraud, directly affects this business sector – obtaining an illicit advantage from operators/Bookmakers is the main objective of those who manipulate the results of sporting events.

5.7 Fraud in the results of sporting events and corruption in sport are efficiently combatted through the formalization of actors, control of the market with legal rules (laws and official regulations) and the adoption of best international practices already recognized in mature markets.

5.8 This is only possible in a legalized and regulated environment, with bets being placed by operators authorized under the terms of the Law, and the Government applying technological management and control tools for the channelized market, with a ban on the offshore and informal market.

(c) To prevent foreign exchange evasion:

5.9 The Central Bank, represented at the public hearing on June 27, 2023, in the Finance and Taxation Committee of the Chamber of Deputies, by the Deputy Head of Conduct Supervision at Bacen, Mr. Waldemar De Sousa, declared that it was observed that, in in just over 5 months (January 1 to June 23, 2023), a financial movement of approximately US$ 8 BI – around R$ 40 billion – was carried out between “remittances and inflows of gaming and betting resources”, while The sum of revenue from Loterias Caixa’s lottery products, including those made available on the Loterias online Caixa website, did not exceed R$24 billion.

This statement from Bacen is sufficient to demonstrate the evasion of foreign exchange and losses that Brazil suffers due to the delay in regulating the aforementioned activity.

(d) For consumer/bettor protection:

5.11 With the market being operated by authorized companies, whether nationally or in the states and DF, the technological tools available for managing bets, competitions and prizes will significantly increase the level of impediment to access to bets by underage and incapacitated people , under the terms of the Law. Only in this environment can prohibited people be effectively prohibited from betting, such as football players themselves, judges, etc., suspicious people and those with compulsive behavior – gamblers.

5.12 Also in this environment, of legal betting in the national territory, it will be possible to identify possible deviations by bookmakers and hold them responsible for their actions due to Brazilian jurisdictional jurisdiction, in the spheres of civil, tax, criminal and other laws.

To generate sponsorship for national sport:

5.13 Currently, although sponsorships are already common, there is no legal certainty regarding the prohibition of exploring and paying foreign lottery prizes in the national territory, in addition to preventing sponsorship from being based on the calculation of the amount wagered.

5.14 Today, 39 out of 409 football clubs in series A and B of the Brazilian Championship receive sponsorship from operators, national and international, who operate betting on sporting events. In a recent survey carried out by Poder 36010, in 2023, sports betting companies are investing around R$327 million to sponsor 19 of the 20 Series A clubs, which gives an annual average of R$17.2 million per team. Without legal certainty, this could generate liabilities for the clubs and others involved.

(f) To generate tax and non-tax revenue for the Union:

5.15 There are estimates that revenue, tax and non-tax, from this market could exceed the sum of ten billion reais per year and, considering that it is a source to finance social demands in Brazil, the only possibility of rejecting or delaying this recipe would be the affirmation that there is no social demand in our country. This results in the urgency and relevance of its immediate and adequate regulation.

(g) To generate revenue for clubs, federations and sports companies:

5.16 The Federal Law that created the lottery modality in Brazil, allowing its commercial exploitation, provides for the mandatory allocation of part of the non-tax revenue to the sporting entities discriminated against in the text of the Law. This will only come into effect when authorized companies are exploiting the products called Fixed Odds Sports Betting – AQF.

(h) To generate employment and income:

5.17 The regulated sector must generate formal jobs and opportunities for professionals in different areas of technology, such as programmers, investment in marketing and advertising, hiring of customer service services, the need to hire professional accountants and administrators, offering property rentals and purchase and sale of equipment for sportsbooks, in addition to the generation of many other direct and indirect formal jobs.

FINAL CONSIDERATIONS:

6.1 Summary below of the motivations for moving forward with the regulation of AQF in Brazil, based on social, economic, public health and jurisdictional aspects:

SOCIAL

a) Integrity of the sport;

b) Legal and controlled offer of bets;

c) Protection of Brazilians/consumers;

d) Generation of employment and income;

ECONOMIC

e) Generation of non-tax revenue (percentage of collection – GGR);

f) Generation of tax revenue (PIS, Cofins, IRPJ, CSLL, ISS and fees);

g) Maintain, in the national financial system, the circulation of bet amounts, prizes and deposits made by bettors;

h) Investments in business structures (establishment of companies, acquisition or rental of properties for the operation of companies, acquisition and maintenance of equipment, furniture, systems, etc., hiring of professionals from different areas – administrators, accountants, lawyers, technology area , marketing etc.);

SAÚDE PÚBLICA

i) Regulation is the most efficient way to prevent gambling disease;

j) Allocate resources to recovery entities for potential gambling addicts;

k) Possibility of marketing campaigns warning of the dangers of compulsive betting;

OPERATORS’ RESPONSIBILITIES UNDER BRAZILIAN JURISDICTION

l) Hold the company responsible for any failure to protect compulsive gamblers;

m) Civil, tax, criminal, labor and other legal liabilities, under the supervision of Brazilian jurisdiction.

7. SUGGESTIONS

a) Regulate the AQF as per Law 13,756/2018, adopting the authorization institute in a competitive environment

b) Concomitantly, albeit through a future bill, aiming at the progressive improvement and modernization of the public service and the regulation of sports betting in the country:

b.1 Eliminate taxation on the lottery player’s prize that is the subject of this study, for the reasons already explained in this study;

b.2 Define as the calculation basis for the incidence of IR on the prize the total wagered minus the prize, also taking into account the IRPF table, and establish as the generating fact the profit obtained between the total bets and the prize, calculated in the same fiscal year .

It is necessary to note, finally, that the relatively more precarious nature of the authorization institute allows greater flexibility to the Public Power, notably when defining the risk allocation, if it becomes necessary to make the necessary adjustments between the first delegations of the service and the improvements that may be necessary at a later time.

7.2 In the same vein, it is worth remembering that there is no acquired right to a legal regime – in this case, a possible change from authorization to concession. Furthermore, national law has sufficient instruments to ensure the transition from one regime to another, as set out in art. 23 of the Law of Introduction to the Standards of Brazilian Law.

7.3 Therefore, the immediate regulation of Law 13,756/2018, in accordance with the current text, based on the constitutional prerogative provided for in art. 84, IV of CF/88, at the same time would achieve better levels in terms of the integrity of the sport, reduced tax evasion, consumer protection and would ensure important tax and non-tax revenue for the Union.

These are the contributions.

Brasília, Federal District, on September 11, 2023.

Roberto Carvalho Brasil Fernandes OAB/SC 20.080

Alexandre José Mattos do Amaral Filho OAB/SC 37.828

Rafael Biasi OAB/SC 58.767

Daniel Roberto Zanoni Fernandes OAB/SC 35.008