Playtech publishes the second edition of its “Responsible Gaming: Consumer Insights and Trends in Latin America”, which offers an analysis of online gamblers’ preferences, providing valuable insight into the concerns and needs of punters in regulated and soon to be regulated markets.

This shows that 60% of Brazilian respondents reported gambling online in the past six months. Playtech’s report is not restricted to Brazil, but covers 21 different countries and territories.

Despite this, the survey focuses on five of the six largest markets by population in a region that is home to more than 680 million people.

The regional team of Playtech commercial, regulatory affairs and safer gaming experts, Francesco Rodano, Chief Policy Officer, Charmaine Hogan, Head of Regulatory Affairs and Pedro Extremera, Regional Director, believe this report can serve as a model for operators who wish to operate in the region.

Playtech report results

The Latin American market is expected to reach a value of $3.4 billion by the end of 2025, and with this level of growth, understanding the needs of gamers is critical.

After all, breaking into the Latin American market is a tricky road for operators, despite its ‘hidden gem’ status. Countries are still at different stages of regulation.

While the sector in Argentina has been regulated for several years, countries like Colombia and Peru are still relatively new, with Brazil only regulating sports betting.

Brazil and the passion for football

One of the examples pointed out by the report was the region’s enduring love affair with football. Brazil and Argentina were both ahead of the curve when it came to markets ahead of the 2022 World Cup held in Qatar. The Argentines led by Lionel Messi lifted the cup.

The passion for sport is also evident in the betting – according to reports, 67% of bets placed in Latin America are on football.

As with any growth market in the gaming industry, the challenge of keeping players safe is always at the forefront of operators’ strategy.

Playtech’s report highlights the need for operators to not only educate players on what responsible gaming looks like, but also on the player protection tools available to them.

Fines or even loss of license are two potential remedies if operators fail to provide evidence of responsible gaming practices, something seen before in Europe, with regulators handing out multi-million fines for social responsibility and AML liability.

Diversity in gaming behaviors in Latin America

Despite the similarities when it comes to gaming preferences, Playtech’s Responsible Gaming Report shows clear differences in players’ gaming patterns across the five Latin American countries analysed.

For example, when asked if they played online in the last six months, 53% of respondents in Argentina said yes. This is the lowest value of all five countries.

Brazil was in second place with 60%, followed by Chile (68%), Colombia (75%) and Peru (82%). It’s data like this that makes the report such a valuable tool, explains Francesco Rodano.

“The findings of the Responsible Gaming Report provide valuable information that can help industry bodies and operators design and strengthen their responsible gaming and customer experience strategies across Latin America,” he says.

“The insights also provide a country-by-country view of perceptions in each market, which can be vital when operators are trying to penetrate the wider region.”

The report also shows that players’ experiences and the repercussions of these experiences differ from country to country.

For example, 52% of respondents in Brazil said they had received a warning about how much money they were betting; in Argentina, only 16% took this warning.

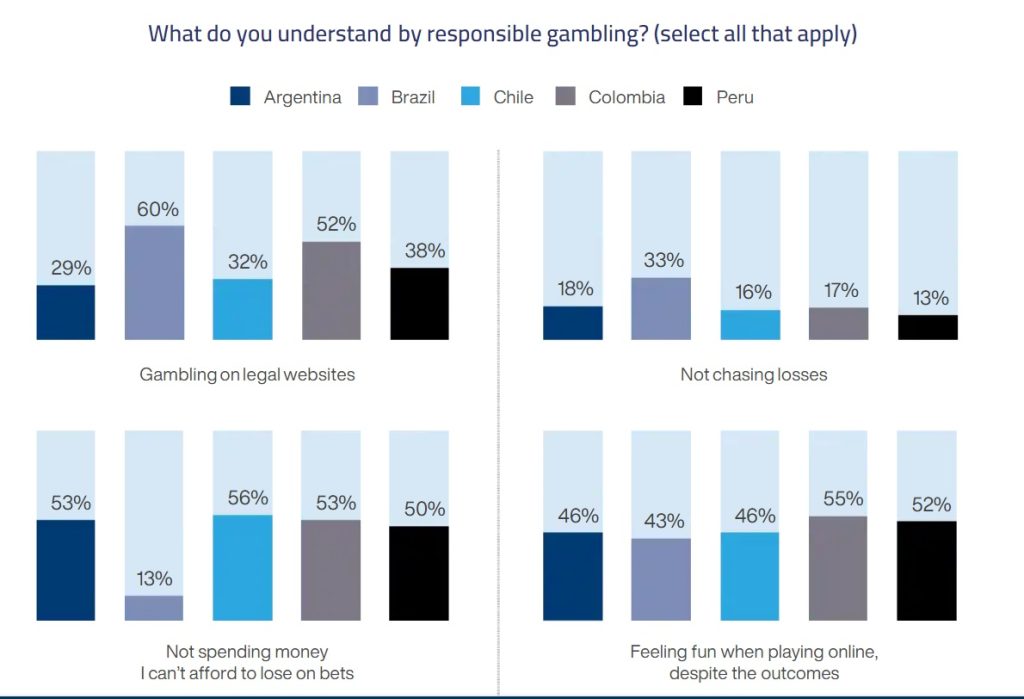

Cultural nuances play a role in both patterns of gambling and perceptions of what responsible gaming means – so much so that 60% of respondents in Brazil would classify gambling on legal websites as responsible gambling, while just 29% in Argentina think so.

Playtech study addresses regulation

With these key learnings, as well as the findings from the Playtech report, Hogan believes operators have some clear guidance for when to enter the Brazilian market, as well as the broader Latin American market.

“As the market matures in Brazil and other Latin American markets, we believe regulation can play an important role in establishing a consistent framework to protect participants under local regulation.

“At the same time, operators are responsible, especially in newly regulated markets, to go beyond minimum regulatory requirements and continually improve ways to promote player protection.”

Brazil: A challenging market for iGaming operators?

With the arrival of a new gaming era and anticipated growth, Brazil has the potential to be one of the most lucrative opportunities for operators.

Breaking into this new market comes with its own challenges, especially as the report shows that respondents from Brazil received the highest number of gaming notices.

Interestingly, only 13% thought that not spending money they can’t afford to lose on gambling is linked to responsible gambling, compared to 53% in Argentina and Colombia, 50% in Peru and 56% in Chile.

Another important indicator that highlights the need for operators to opt for a reinforced responsible gaming strategy are the “time spent gaming” figures in the report.

Only one in three (32%) of Brazilian respondents said they play for a limited period of time each day. The number is higher in all four other countries, with Peru being the highest at 56%, followed by Colombia (51%), Chile (50%) and Argentina (41%).

These results demonstrate the need for operators to have responsible gaming strategies, such as behavioral alert messages triggered by triggers or enforced deposit limits, before entering the market.

But operators are not the only ones who have an important role to play in helping to solve this problem. Regulation is key to educating players about harmful gambling, similar to how it has been handled in Europe.

Playtech’s full report can be accessed here.